Market-Aligned Section 8 Rents: Enhancing Property Performance Through Strategic Market Alignment

The Project-Based Section 8 program offers property owners stable income while supporting the national mission of providing quality affordable housing. Yet many owners operate with below-market Section 8 rent structures due to common industry assumptions and outdated practices. The key to successful Section 8 property performance enhancement is achieving proper market alignment between your contract rents and comparable private market properties.

Let's explore opportunities that may be quietly limiting your property's performance potential.

Opportunity #1: Understanding HUD's Market Alignment Policy

The Strategic Advantage: HUD policy explicitly supports Section 8 rents that are comparable to market-rate properties, not discounted from them. According to the Section 8 Renewal Policy Guidebook, approved rents should be "comparable to rents charged for unassisted units in the private market."

This means your Section 8 property should receive rents comparable to similar market-rate properties when accounting for location, condition, amenities, and services. There is no policy requirement or expectation that Section 8 rents be lower than market rates. A proper HUD Rent Comparability Study will confirm your property's market positioning opportunities.

Opportunity #2: Leveraging SAFMR Analysis for Enhanced Performance

The Market Alignment Advantage: Fair Market Rent (FMR) serves as a statistical benchmark primarily used for the Housing Choice Voucher program, not as a rent ceiling for Project-Based Section 8 properties. When pursuing appropriate contract rents, properties undergo a Rent Comparability Study (RCS) process that evaluates true market potential beyond simple FMR metrics.

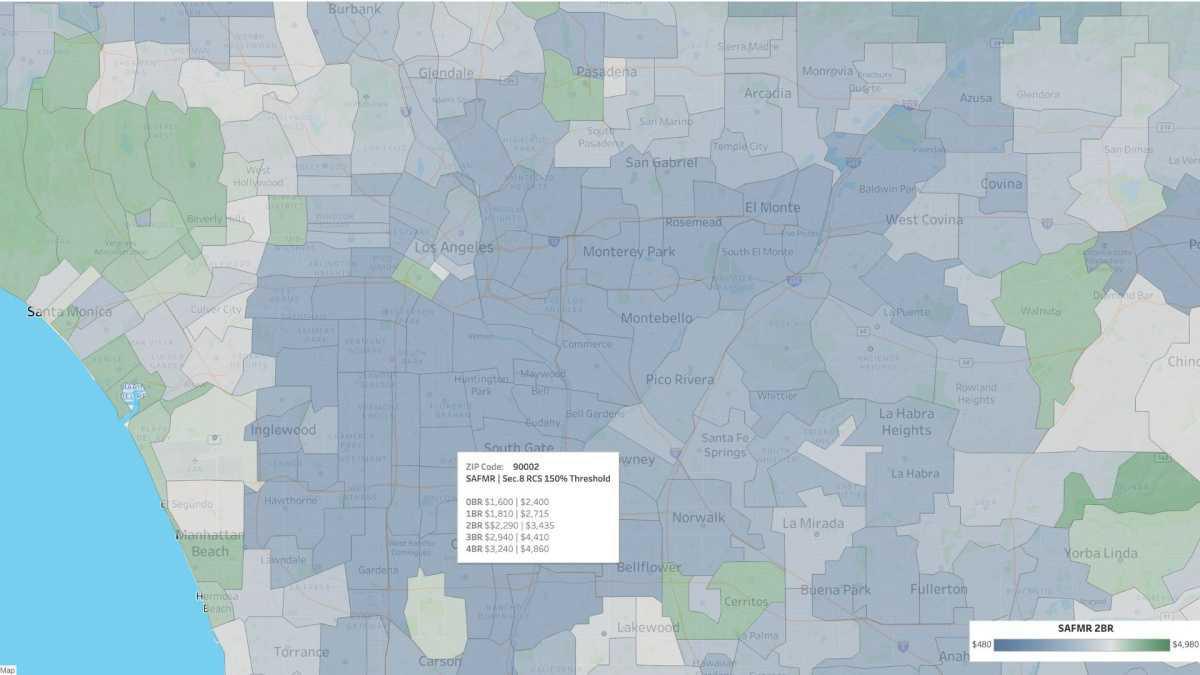

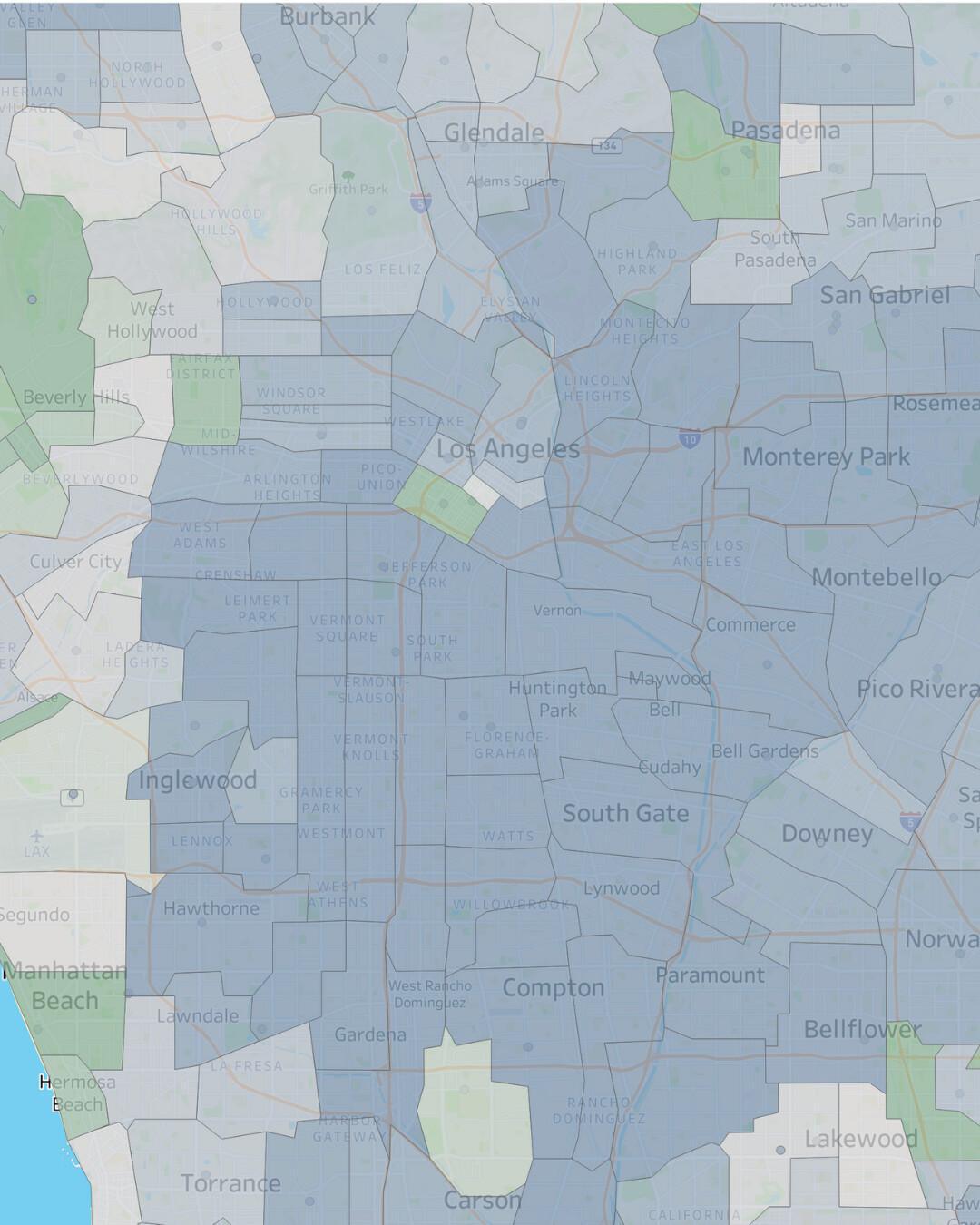

According to HUD's Section 8 Renewal Policy Guidebook, particularly under Option 1: Mark-Up-To-Market, owners can request rents that exceed traditional benchmarks when justified by an RCS. Significantly, the HUD RCS Threshold Test requirement is based on 150% of Small Area Fair Market Rent (SAFMR), not the broader metropolitan FMR. This distinction creates substantial property performance enhancement opportunities, as SAFMRs are calculated at the ZIP code level to better reflect neighborhood-specific market conditions.

Discover Your Property's Market Alignment Potential: Access Our Exclusive SAFMR Analysis Tool ↓

See your property's specific 150% threshold by bedroom size and identify market alignment opportunities in your neighborhood.

A thorough SAFMR analysis can identify neighborhoods where enhanced performance is fully supported by market conditions. Properties located in high-demand areas and offering superior amenities and services have opportunities for improved property performance.

Opportunity #3: Building Strategic Partnerships with Contract Administrators

The Collaborative Approach: Contract Administrators (CAs) serve as valuable partners in the process who follow HUD policies and procedures to ensure program integrity. When your Rent Comparability Study (RCS) is professionally prepared, thoroughly documented, and compliant with Chapter 9 of the Section 8 Renewal Policy Guidebook, CAs evaluate it based on established criteria that support market alignment objectives.

Building a collaborative relationship with your CA enhances the process, while a well-prepared, compliant RCS with proper HUD Chapter 9 documentation provides the necessary support for achieving market-aligned rents during your Section 8 contract renewal. Professional preparation of your submission helps ensure smooth approval processes and positive outcomes for all stakeholders, creating sustainable property performance enhancement.

Opportunity #4: Recognizing Your Property's Market Value Position

The Value Recognition Perspective: Well-maintained Section 8 properties frequently demonstrate numerous value-creating characteristics comparable to market-rate buildings in terms of physical condition, amenities, and resident services. HUD's Rent Comparability Study (RCS) methodology is specifically designed to recognize these value factors through a structured comparative analysis process that supports market alignment objectives.

Professional appraisers conducting an RCS analyze your property's strengths and identify appropriate market-rate comparables, making value-based adjustments for factors such as unit size, amenities, location, and services provided. This comprehensive process ensures your property receives recognition for its true market value, supporting enhanced property performance through proper market alignment.

Properties with specialized features or resident populations can achieve fair market recognition when properly analyzed. A comprehensive Section 8 rent assessment effectively captures these value propositions and translates them into appropriate rent determinations that reflect your property's actual market position.

Opportunity #5: Maximizing Non-Shelter Services Valuation

The Comprehensive Value Approach: A well-executed Rent Comparability Study (RCS) is designed to reflect your property's distinctive features and services accurately through strategic market alignment principles. HUD's guidelines mandate that appraisers consider various attributes that contribute to a property's market rent. These include:

- Unit Characteristics: Size, layout, and design elements that enhance resident experience

- Property Condition: Maintenance levels and recent renovations that support market positioning

- Amenities: On-site facilities such as fitness centers, community rooms or playgrounds that add value

- Services Provided: Security, transportation, wellness programs, and other non-shelter services

- Utilities: Inclusion of utilities like water, electricity, or internet services that enhance value

- Location advantages: Proximity to public transportation, schools or commercial areas

A professional RCS includes thorough non-shelter services valuation, accounting for security, resident services, transportation assistance, and other amenities that significantly contribute to your property's market value and support enhanced property performance.

When your property's unique features are properly documented and analyzed, you achieve a rent level that truly reflects market value and supports optimal property performance enhancement.

Opportunity #6: Strategic Market Alignment Beyond OCAF

The Proactive Market Positioning Approach: The Operating Cost Adjustment Factor (OCAF) is designed to adjust rents based on changes in operating expenses, not to reflect market rent growth or support strategic market alignment. While OCAF adjustments account for factors like utilities, insurance, and maintenance costs, they often lag behind actual market rent increases, especially in rapidly appreciating areas, creating opportunities for enhanced property performance.

For instance, in many metropolitan regions, market rents increased by 20-30% over a five-year period, while cumulative OCAF adjustments during the same timeframe have been approximately 11-15%. This disparity creates opportunities for property performance enhancement for owners pursuing strategic market alignment.

To ensure rents remain aligned with the market, property owners should consider conducting HUD Rent Comparability Studies periodically. An RCS provides a comprehensive analysis of comparable market rents, enabling owners to achieve appropriate market alignment and identify opportunities to enhance property performance potential.

Opportunity #7: Strategic Investment in Property Performance Enhancement

The Strategic Value Perspective: While initiating a Rent Comparability Study (RCS) requires time and resources, the potential property performance benefits often create substantial value enhancement. Consider this typical scenario that demonstrates market alignment opportunities:

- Property Size: 60 units

- Current Average Rent: $950

- Market-Supported Rent: $1,125

- Monthly Enhancement per Unit: $175

- Annual Performance Gain: $126,000

- Five-Year Contract Impact: $630,000

Even after accounting for the cost of a professional RCS, the property performance enhancement is substantial. Moreover, the adjusted rent becomes the new baseline for future OCAF calculations, compounding the performance benefits over time.

Engaging in an RCS not only ensures compliance with HUD guidelines but also positions property owners to fully capitalize on their property's market potential through strategic market alignment. This is especially important during Section 8 acquisition due diligence to establish accurate baseline valuations for optimal property performance.

The Power of Strategic Documentation for Market Alignment

The key to achieving these opportunities is strategic documentation through a thorough, professionally conducted Rent Comparability Study that supports market alignment objectives.

A well-prepared Rent Comparability Study (RCS) is essential for property owners seeking to achieve market alignment between their Section 8 rents and market rates. According to HUD's guidelines:

- Selection of Comparable Properties: The RCS must include appropriate, truly comparable market properties that support market alignment analysis. HUD emphasizes that comparables should be similar in terms of location, unit and project amenities, age, and condition.

- Documentation of Services and Amenities: All services, amenities, and utilities provided by the property should be accurately captured and documented to support comprehensive non-shelter services valuation.

- Application of Adjustment Factors: Adjustments must be applied according to the guidance provided in Chapter 9. These adjustments account for differences between the subject property and the comparables, ensuring an accurate estimation of market-aligned rents.

- Professional Documentation for Review: The RCS should present clear, professional documentation to facilitate review by Contract Administrators during Section 8 contract renewal. This includes the use of standardized forms like the Rent Comparability Grid (Form HUD-92273-S8) and adherence to the instructions provided in the guidebook.

- Justification with Market Data: Rent conclusions must be justified with supporting market data through comprehensive SAFMR analysis. This involves a thorough analysis of the local rental market and the inclusion of relevant data to substantiate the proposed rents and support market alignment objectives.

By adhering to these guidelines, property owners can ensure that their HUD Rent Comparability Studies support market alignment while complying with HUD standards, thereby facilitating the approval process for rent adjustments that enhance property performance.

Pursuing market-aligned rents through a comprehensive and well-documented RCS represents strategic property performance enhancement that ensures property owners receive appropriate compensation in line with HUD's commitment to providing quality affordable housing.

Before committing to a full RCS, consider starting with a preliminary rent assessment to identify potential market alignment opportunities. This cost-effective approach through the Phased RCS approach can quickly determine if your property's current rents are misaligned with market rates, supporting informed decision-making for property performance enhancement.

Start with Our SAFMR Analysis Tool: See Your Market's Alignment Opportunities →

Take Action: Schedule Your Market Alignment Consultation

If your Section 8 property hasn't undergone a professional rent evaluation recently, you may have untapped opportunities for property performance enhancement. Our specialized team helps forward-thinking Section 8 property owners unlock strategic value through comprehensive market alignment and optimization of their contract rents.

Resources:

- More Than Just Features: How Strategic Amenities Build Thriving Multifamily Communities

- The Amenity Revolution: Transforming Multifamily Living

- 7 Indicators Your Property Requires Market Alignment

- HUD Introduces New 150% Mandatory Market Rent Threshold Test

- HUD FY 2025 Small Area Fair Market Rents (SAFMR) - Sec.8 RCS 150% Threshold

- HUD's Section 8 Renewal Policy Guidebook (March 2023)

- HUD's Small Area Fair Market Rents Database