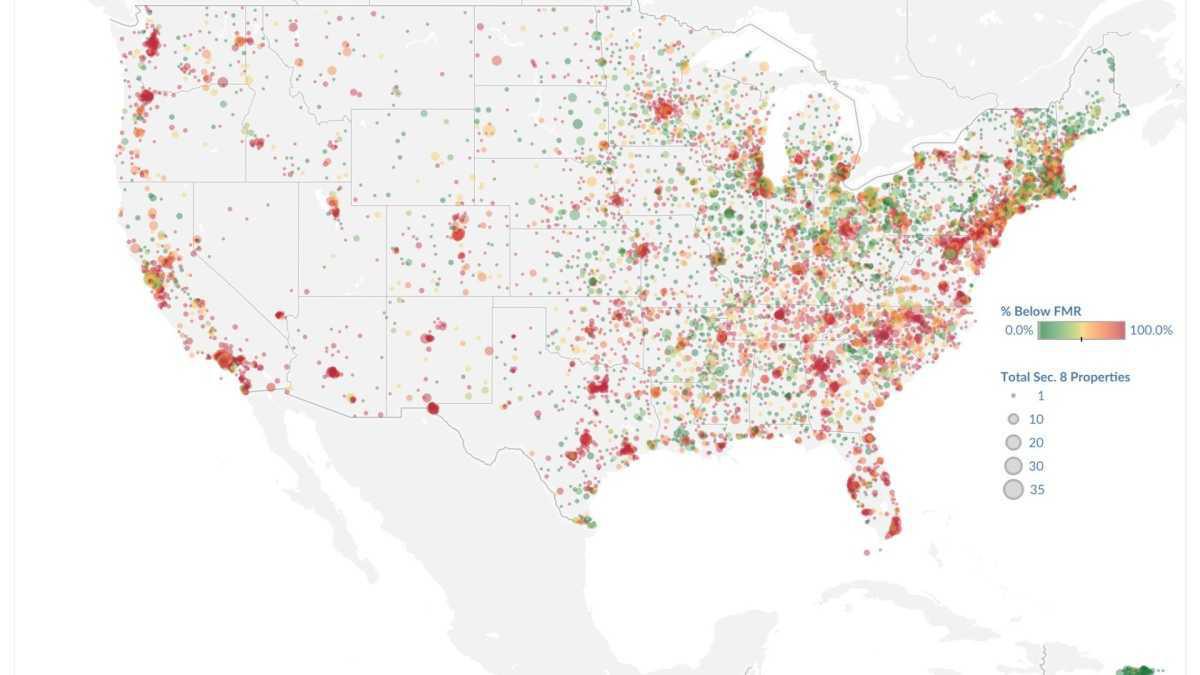

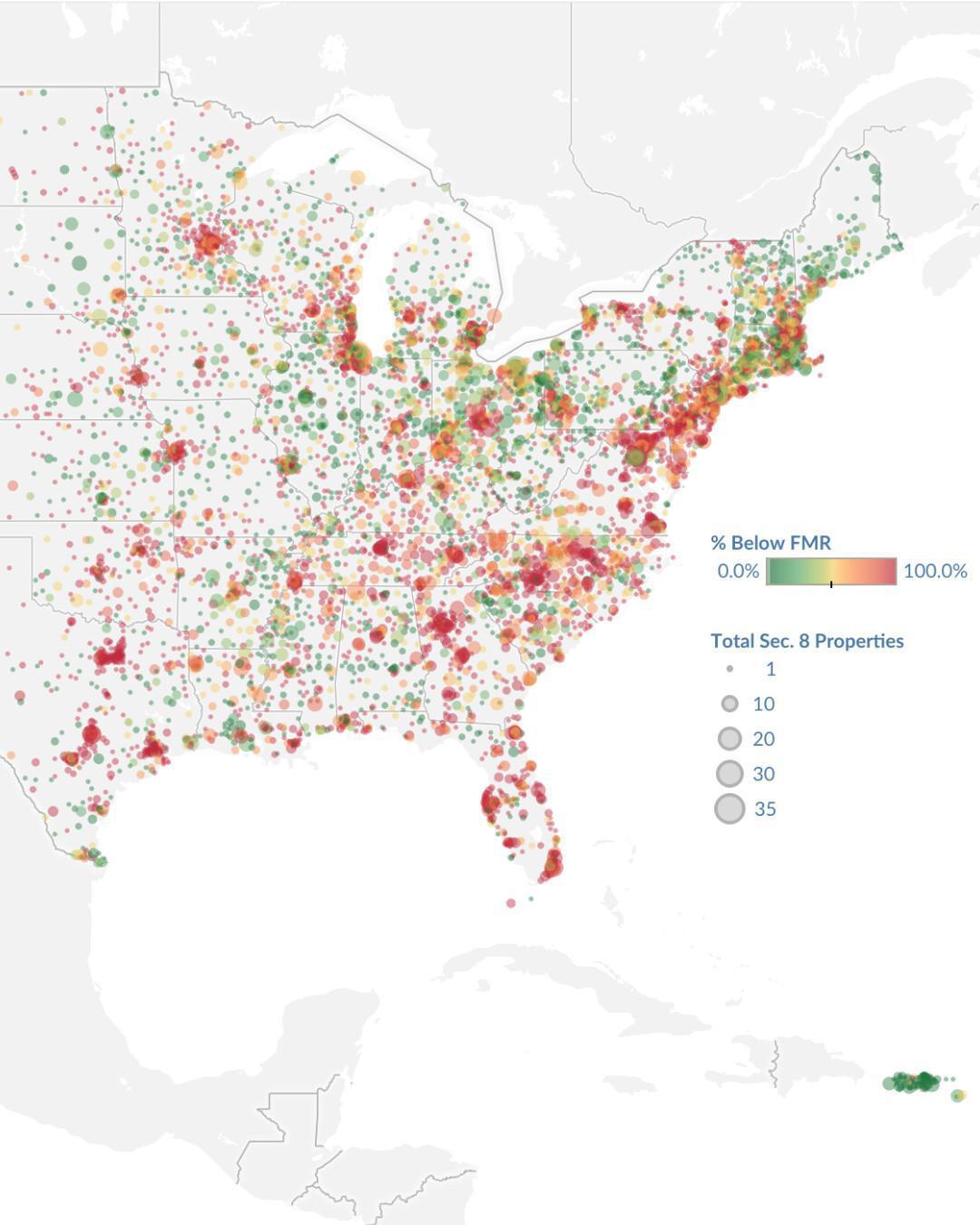

Our latest HUD rent analysis across multiple markets confirms a widespread pattern—many Section 8 properties operate significantly below their potential Fair Market Rent values, creating substantial Section 8 market alignment opportunities.

The Opportunity

The affordable housing landscape is evolving. Properties require capital improvements, operating costs continue to rise, and resident service needs are expanding. Strategic market alignment is essential for maintaining quality housing and addressing these evolving needs.

Recent updates to HUD's Section 8 Renewal Policy Guidebook have created opportunities for property owners to align their rents with market values during Section 8 contract renewal, yet many haven't yet leveraged these changes to enhance property performance.

Understanding HUD's Section 8 Renewal Policy Guidebook

HUD Rent Comparability Studies (RCS) serve as a foundation for ensuring both property performance and regulatory compliance of Section 8 developments. These studies provide accurate market rent data, which is essential for making informed decisions about property enhancements during Section 8 contract renewal.

The latest updates introduce more streamlined processes, reducing administrative complexities and improving operational efficiency. The changes were designed to "streamline the contract renewal process" and "clarify the conditions under which such rents may reflect the value of providing services to residents."

Key enhancements include:

-

Recognition of internet service valuation as eligible for non-shelter services valuation

-

Enhanced consistency standards for Section 8 rent assessment

-

Streamlined processes for Rent Comparability Studies

-

Updated methodologies better aligned with current market conditions

Pathways to Strategic Market Alignment

1. Leveraging Small Area Fair Market Rent (SAFMR) Analysis

The introduction of Small Area Fair Market Rents (SAFMRs) represents a strategic shift in rent potential calculations. Rather than applying broad metropolitan-wide standards, SAFMRs calculate rental rates at the ZIP code level, acknowledging the significant variation between neighborhoods.

This approach means your property's Section 8 rent potential might be considerably higher than previously understood, particularly if your property is in a high-demand neighborhood—creating a meaningful opportunity for market alignment.

2. Non-Shelter Services Valuation

A significant opportunity stems from HUD's March 2023 update to Chapter Nine of the Section 8 Renewal Policy Guidebook. This update "enhances consistency in valuing non-shelter services" and "allows internet and broadband services to be considered an eligible non-shelter service for valuation purposes," effective May 1, 2023.

This policy enhancement represents a substantial opportunity for property owners who provide resident services and amenities but haven't incorporated their value into rent determinations during the Section 8 rent assessment process.

3. Optimizing Your Section 8 RCS for Market Alignment

The HUD Rent Comparability Study forms the foundation of Section 8 rent determination and is critical for Section 8 contract renewal. To enhance property performance through market alignment, attention should be paid to:

-

Selection of appropriate comparable properties

-

Proper documentation and valuation of non-shelter services

-

Recognition of neighborhood-specific amenities

-

Methodologies that align with current HUD Chapter 9 compliance guidelines

Strategic Partnership: A Case Study

A non-profit organization with a national portfolio sought to invest in capital improvements and resident services to enhance their resident experience at a West coast elderly development. For years, the property maintained modest annual rent increases.

The property was in an area of significant new apartment construction. Our SAFMR analysis and Below FMR assessment revealed that the contracted rents were 31% below the market and current Small Area FMR for their ZIP code. Additionally, the property offered several services that weren't being properly valued:

-

High-speed internet access eligible for internet service valuation

-

On-site security

-

Community room with computer access

-

Resident activity programming

They utilized our phased RCS approach to navigate the latest HUD guidelines and align their rents with surrounding market-rate properties. Starting with a preliminary rent assessment, we identified an opportunity for market alignment, representing an additional $190,000+ in annual property performance enhancement while maintaining full HUD Chapter 9 compliance.

Identifying Opportunities for Market Alignment

To determine if your property might benefit from strategic market alignment, consider this three-step evaluation process as part of your due diligence:

Step 1: Assess Your Current Small Area FMR

Review the current Small Area FMR for your property's ZIP code using HUD's SAFMR database, noting rates specific to each bedroom size in your property portfolio.

Step 2: Compare to Your Current Contract Rents

Compare your property's current contracted rents to the SAFMR for each unit type to identify potential opportunities through a below FMR assessment.

Step 3: Evaluate Your Non-Shelter Services

Identify all services your property provides that might not be fully valued in your current rent structure, with particular attention to internet service valuation now recognized as eligible following the 2023 HUD update.

The Phased RCS Approach to Market Alignment

For properties potentially operating at below-FMR levels, our phased RCS approach offers a strategic pathway:

Phase 1: Preliminary Rent Assessment

We conduct a comprehensive analysis of your property's current rents compared to the market and applicable SAFMRs. This preliminary assessment identifies potentially undervalued non-shelter services and estimates your property's strategic alignment potential.

Phase 2: Full Section 8 RCS

If the preliminary assessment identifies significant opportunity, we proceed with a full HUD Rent Comparability Study. Our specialized expertise ensures your Section 8 contract renewal captures the appropriate market alignment through our phased RCS approach. This is also ideal for Section 8 acquisition due diligence.

Long-Term Value Through Strategic Market Alignment

Market alignment represents a significant opportunity for Section 8 property owners to enhance property performance while improving resident services. With HUD's updated guidance and the right strategic partnership, aligning with market values has never been more straightforward.

About Clarendon: Clarendon specializes in Section 8 market alignment through expert HUD Rent Comparability Study services and non-shelter services valuation. Our phased RCS approach has helped property owners nationwide identify below-FMR situations and enhance property performance through successful Section 8 contract renewals.

Resources:

- Clarendon to provide Southern California RCS Reviews

- Clarendon secures renewal of HUD contract for Section 8 Rent Comparability Studies in the Northeast region

- More Than Just Features: How Strategic Amenities Build Thriving Multifamily Communities

- The Amenity Revolution: Transforming Multifamily Living

- HUD Introduces New 150% Mandatory Market Rent Threshold Test

- HUD FY 2025 Small Area Fair Market Rents (SAFMR) - Sec.8 RCS 150% Threshold

- HUD's Section 8 Renewal Policy Guidebook (March 2023)

- HUD's Small Area Fair Market Rents Database