In our article "The Hidden 15%: How Market Rent Analysis Can Increase Your Real Estate Investing Returns", we revealed a startling insight: most independent landlords are unknowingly leaving 8-15% of their potential rental income on the table. This "hidden 15%" represents thousands of dollars in lost annual revenue for property owners who rely on intuition-based pricing methods.

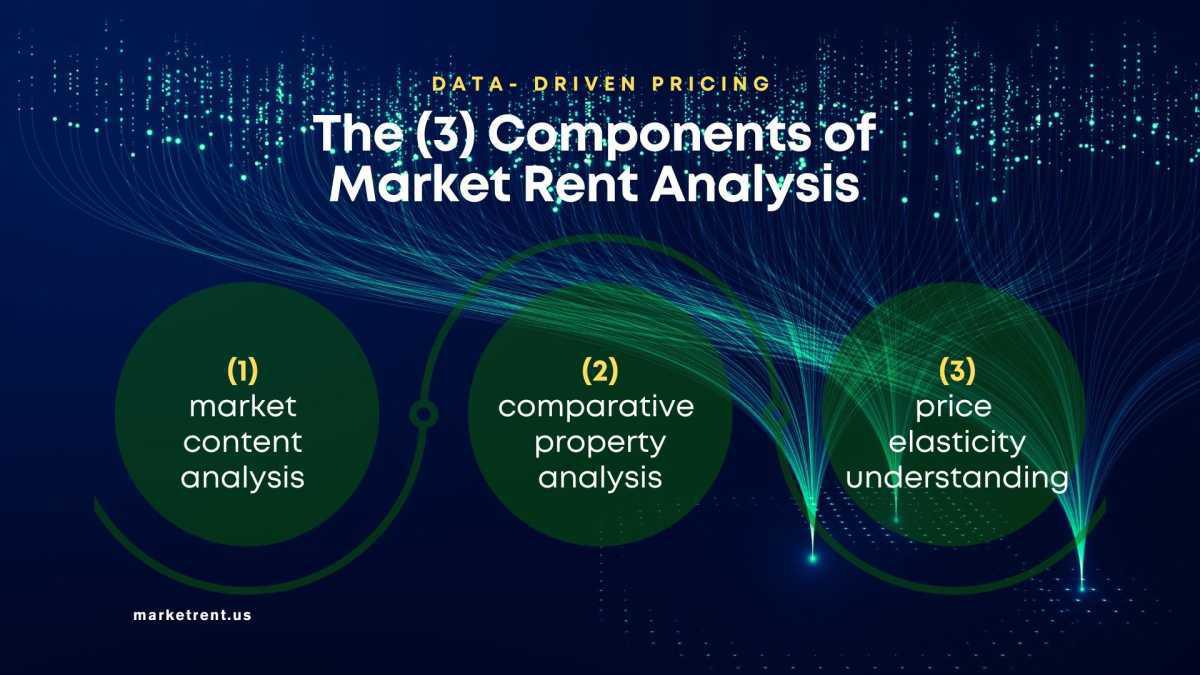

In this article, we introduce a framework that will help you recapture this lost income potential. By mastering the three essential components of data-driven rental pricing through market rent analysis, you can transform your pricing decisions from guesswork to science—giving independent investors the same strategic advantages that institutional property owners have long enjoyed.

The Evolution of Market Rent Analysis

Most landlords understand the importance of setting the right price. However, few recognize that pricing is not merely a decision point but an ongoing strategic process. Modern market rent analysis is built on three fundamental pillars that work together to maximize your rental income:

-

Market Context Analysis: Understanding the broader forces shaping your rental market

-

Comparative Property Analysis: Using structured data to determine true property value

-

Price Elasticity Understanding: Optimizing the relationship between price and demand

This framework represents a fundamental shift in how independent landlords approach pricing decisions, transforming your strategy from intuition-based to data driven.

Component #1: Market Context Analysis

The first component involves developing a comprehensive understanding of the broader market ecosystem in which your properties exist. This perspective shift moves you beyond just looking at comparable properties to seeing the larger forces shaping your market.

The Market Ecosystem Perspective

Think of your rental property as existing within a complex, interconnected ecosystem where multiple forces influence value:

-

Supply and demand dynamics: The balance of available units versus potential renters

-

Seasonal and cyclical patterns: How timing factors affect pricing power

-

Neighborhood evolution: How development patterns change the character and value of area

-

Economic indicators: How employment, income, and migration patterns impact rent

The Real Estate Investing Advantage

Market Context Analysis represents a fundamental shift from isolated property comparison to ecosystem thinking. This perspective illuminates the invisible forces that create pricing opportunity—forces that intuition-based pricing typically misses entirely.

By developing this broadened perspective, you gain insight into not just current pricing opportunities but also emerging trends that will shape future value. This forward-looking approach is a hallmark of real estate investing strategy.

Component #2: Comparative Property Analysis

The second component involves evolving beyond surface-level comparisons to a structured framework for evaluating relative property positioning. This represents a shift from subjective to objective comparison methodology.

The Value Attribution Challenge

One of the most significant challenges in rental pricing is determining how specific features and differences contribute to value. This is where most intuition-based approaches fall short, relying on gut feeling rather than structured analysis.

The breakthrough comes from understanding that property comparison is not a simple checklist but a weighted system where:

-

Different features carry different value weights

-

These weights vary by market and demographic

-

Value relationships aren't always linear

-

Perceived value often differs from actual contribution to rent potential

The Market Rent Calculator Advantage

Comparative Property Analysis transforms the typical landlord question from “What are similar properties charging?” to “What creates value in this specific market?” A sophisticated market rent calculator is built on this foundation, incorporating value attribution models rather than simple averages.

This component allows you to:

-

Identify undervalued property features

-

Recognize overvalued comparison factors

-

Develop market-specific value equations

-

Quantify the true impact of property improvements

Component #3: Price Elasticity Understanding

The third component involves recognizing that pricing is not a fixed point but a dynamic relationship between price and demand. This represents perhaps the most significant conceptual leap in data-driven pricing.

The Dynamic Pricing Perspective

Price elasticity—how demand responds to price changes—is a concept well understood in economics but rarely applied thoughtfully in rental property pricing. The key insight include:

-

Every property has an optimal price point that maximizes revenue

-

This optimal point isn't necessarily the price that minimizes vacancy

-

The relationship between price and demand is a curve, not a cliff

-

This curve varies by property type, market, and timing

The Real Estate Investing Tools Advantage

Price Elasticity Understanding moves landlords from the binary thinking of "rented versus vacant" to the optimization perspective of "maximum sustainable revenue." This shift transforms pricing from a fear-driven decision to a strategic optimization.

This component helps answer critical questions like:

-

How much rental income am I sacrificing to achieve faster leasing?

-

What is the true financial cost of a vacancy versus underpricing?

-

How can I test price sensitivity without significant risk?

-

What signals indicate I've found the optimal price point?

Modern real estate investing tools are now incorporating elasticity modeling, bringing sophisticated revenue management techniques to independent investors.

The Strategic Integration Model

The greatest value emerges when these three components are viewed not as isolated techniques but as an integrated strategic framework. This holistic perspective creates a continuous improvement cycle that elevates your entire approach to property pricing.

The Strategic Interplay

Each component informs and enhances the others:

-

Market Context Analysis provides the foundation for understanding broader value drivers

-

Comparative Property Analysis translates these drivers into property-specific positioning

-

Price Elasticity Understanding optimizes revenue potential based on market response

The resulting data feeds back into all three components, creating a learning system.

This integrated approach represents a true competitive advantage, allowing independent landlords to implement institutional-quality pricing strategy without enterprise-level resources.

Technology as Enabler

Advanced real estate investing tools are making this integrated approach increasingly accessible to independent investors:

-

Data aggregation platforms are democratizing market insights

-

Algorithm-driven comparable analysis is becoming more sophisticated

-

Predictive analytics are bringing elasticity modeling to the mainstream

-

Integration platforms are connecting these components into cohesive systems

These technological advancements are rapidly closing the gap between intuition-based and data-driven pricing for independent landlords.

The Mindset Evolution

Beyond the technical components, implementing data-driven pricing requires a fundamental mindset evolution:

From Reactive to Proactive

Many landlords set prices reactively responding to vacancies, emergency situations, or annual lease renewals. The market rent analysis approach shifts to a proactive stance where pricing is an ongoing strategic process rather than a periodic decision point.

From Fear to Confidence

Intuition-based pricing is often dominated by fear—particularly the fear of vacancy. Data-driven methodology replaces this fear with confidence built on systematic analysis, allowing for strategic decisions that optimize long-term revenue rather than minimizing short-term risk.

From Isolated to Communal

The most sophisticated landlords recognize that data quality improves with scale. By participating in data-sharing networks and industry associations, independent investors can collectively achieve market insights that rival institutional knowledge.

Looking Forward: The Pricing Evolution

As you begin to incorporate these three components into your approach, remember that this is an evolutionary process. Most landlords start with basic implementation of one component and gradually expand to the integrated framework.

The market rent analysis methodology we've outlined represents a conceptual model derived from our analysis of thousands of successful pricing decisions across markets nationwide. By embracing these concepts, independent landlords can begin to close the strategic gap with institutional investors and recapture that hidden 15% of rental income potential.

Resources and Further Reading:

- The Hidden 15%: How Market Rent Analysis Can Increase Your Real Estate Investing Returns

- A New Era for South Los Angeles: What's Driving the Market's Maturity?

- Motor City No More? How Detroit Became a Leader in Urban Innovation

- The Amenity Revolution: Transforming Multifamily Living

- Creating a Sense of Belonging: Why Community Amenities Matter More Than Ever